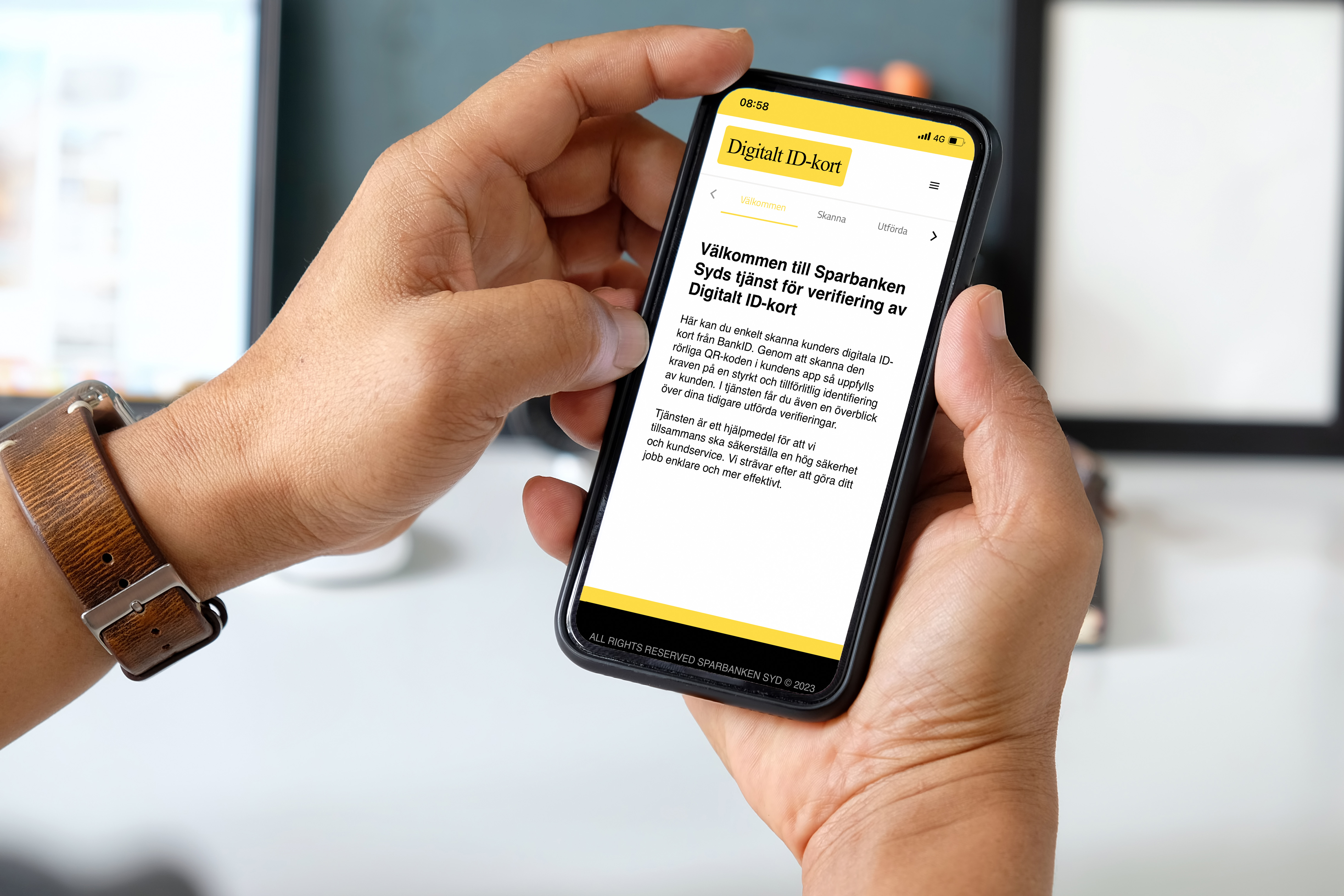

Sparbanken Syd verifies digital ID card with own app

2023-09-27

When the digital ID card from BankID was launched, Sparbanken Syd was ready to accept it already from day one.

Good cooperation and being highly proactive enabled the bank to immediately welcome their customers that have a digital ID card.

“We are a small bank that believes in the importance of being a modern and comprehensive bank for our customers,” explains Head of IT Peter Appelros. “We have a strong local presence, and many of our customers come to our branches in person. It felt natural that customers who wanted to use a digital ID card should be able to do so with us. We also see many advantages to using the digital ID card.”

Confident about the security of the digital ID card

The digital ID card has many layers of security, and secure verification is easy, regardless of whether it is done visually or by scanning the mobile QR code.

“We are very confident about the security of the digital ID card,” says Head of Development Mårten Jönsson.

The customer has a secure ID document from the police underlying their digital ID card, and this ID document is carefully verified when the digital ID card is activated.

Customers must identify themselves through BankID every time they want to show their digital ID card.

Every time our app scans the mobile QR code, the digital ID card is verified through BankID to confirm that it is real.

The digital ID card contains several security details, for example visual and sound effects, that employees can verify.

Because we scan the QR code using the BankID interface, we receive a proof of identification that can be saved in the bank’s system when needed for certain types of matters.

App – fast, convenient and cost-efficient

All employees at Sparbanken Syd receive an iPhone from their employer. The hardware is therefore already in place, which meant that an app was the smartest way to push the solution to employees.

“The app can be easily downloaded to their work phone,” says Mårten. “We do not have to order and install scanners or anything like that at the service counters at the branches. We have prepared all we need to do so in the future if that solution is needed, but currently our branch staff are very satisfied with the mobile solution, which allows them the freedom to move around the office. They can identify customers in meetings or in other parts of the office without needing to find an available service counter.”

Training, procedures and risk analysis key components

Johannes Mårtensson works for the bank's IT department and was running the project. He asserts that the technology was the easiest component because they could simply follow the technical specification from BankID. What took more work was to update the documentation and procedures to ensure that the app met all of the requirements. This work also included the key activity of allowing for time to train the staff on how to use the app to verify the digital ID card and how the ID card functions.

“The key word has been proactive,” says Johannes. “For example, our colleagues from Risk and Compliance were with us at an early stage of the project, and we have been able to work agilely with them. Our branch staff were also able to receive information in advance and try out the app in a test environment before it went live. Every branch has had an ambassador who was explicitly responsibility for this. BankID gave us great help with good training material and with our terminology in the app, which made things a lot easier.”

Looking forward to the future with BankID

Sparbanken Syd is an issuer of BankID and is pleased with the collaboration.

“We have gotten great help, material and clear technical specifications from BankID,” says Peter. “It has, like always, been a very rewarding team effort, and we look forward to continuing to work together in the future.”